Linking Venmo to TikTok Shop is a question many shoppers and sellers are asking as the platform continues to grow in e-commerce. With over one billion people buying products directly through the app, and an estimated 58% of TikTok users shopping on it, knowing how payments actually work should be essential both for customers and businesses.

Here’s the key point: Venmo can be used by buyers at checkout, but it is not a way for sellers to receive payouts.

In this guide, we’ll explain how Venmo fits into TikTok Shop’s payment setup, walk you through TikTok’s official payment process, and highlight the scams that try to exploit confusion.

Venmo: Easy and Secure Checkout for Shoppers

For shoppers, using Venmo on TikTok Shop feels just like a natural part of the checkout process. Venmo and TikTok have built an official partnership, and you’ll notice it right away through the ads and promotions running on the app.

You’ve probably come across videos offering deals like “20% off your first TikTok Shop purchase when you pay with Venmo.” These campaigns show that the integration isn’t just a small feature, it’s a core strategy to encourage more people to complete their purchases instead of leaving items in the cart.

Inside TikTok Shop, Venmo works as a secure e-wallet option. Once you pick a product, checking out with Venmo is quick, simple, and protected.

The Step-by-Step Checkout Process with Venmo

Here’s how the checkout works when you choose Venmo as your payment option:

- Proceed to Checkout: After adding an item to your cart, tap the checkout button when you’re ready to buy.

- Choose Your Payment Method: On the payment screen, you’ll see several options, credit or debit cards, e-wallets like Apple Pay and Google Pay, and “buy now, pay later” services such as Klarna and Affirm. Venmo will be listed among these e-wallet choices.

- Link Your Venmo Account: Once you select Venmo, you’ll be redirected to an authorization page or the Venmo app itself. Log in and confirm your purchase. The process is fully encrypted, which means your financial details never pass through TikTok.

Instead, they’re processed by a licensed third-party provider for added security. That way, both TikTok Shop and Venmo’s own protections work together to keep your transaction safe.

Other Payment Options You Can Use

Venmo is just one part of TikTok’s bigger plan to make checkout as flexible as possible. By offering a wide mix of payment methods, the platform makes it easier for people to shop the way they prefer. Here’s what else you can use:

- Credit/Debit Cards: TikTok Shop accepts all the major brands—Visa, Mastercard, American Express, and Discover. You can even save your card details for future purchases and update or remove them anytime.

- PayPal: Similar to Venmo, PayPal is a trusted e-wallet. When you choose it, you’ll be redirected to PayPal’s site to log in and confirm the payment—a process many users already know and rely on.

- Apple Pay and Google Pay: If you’re on iOS or Android, these mobile wallets make checkout almost instant with a single tap. Many shoppers find them especially handy when other methods don’t go through smoothly.

- Buy Now, Pay Later (BNPL) Services: TikTok has also teamed up with Klarna and Affirm. These services let you break a purchase into smaller, interest-free payments, which can make bigger buys more manageable.

While the official documentation presents a flawless user experience, it’s worth noting that some users have reported minor technical frictions, such as being sent back to the app during checkout.

These are typically not signs of a scam but rather of a maturing system. Simple troubleshooting steps like clearing your app cache or restarting the app can often resolve these issues.

Sellers and Venmo: What You Need to Know

Many sellers assume they can link Venmo to receive their TikTok Shop payouts, but that’s not how the system works. Venmo is reserved for buyers at checkout, it’s never used to transfer earnings to sellers. This distinction is intentional and serves as an important safeguard.

Instead, all seller payments are deposited directly into a verified bank account. To set this up, sellers use the TikTok Shop Seller Center, a secure portal separate from the main app. This structure is designed to meet financial regulations while ensuring every transaction remains legitimate, traceable, and fully protected.

How Seller Payouts Work on TikTok Shop

For sellers, understanding how payouts are handled is just as important as knowing which payment options buyers can use. TikTok Shop keeps seller payments completely separate from consumer e-wallets like Venmo to ensure security and compliance.

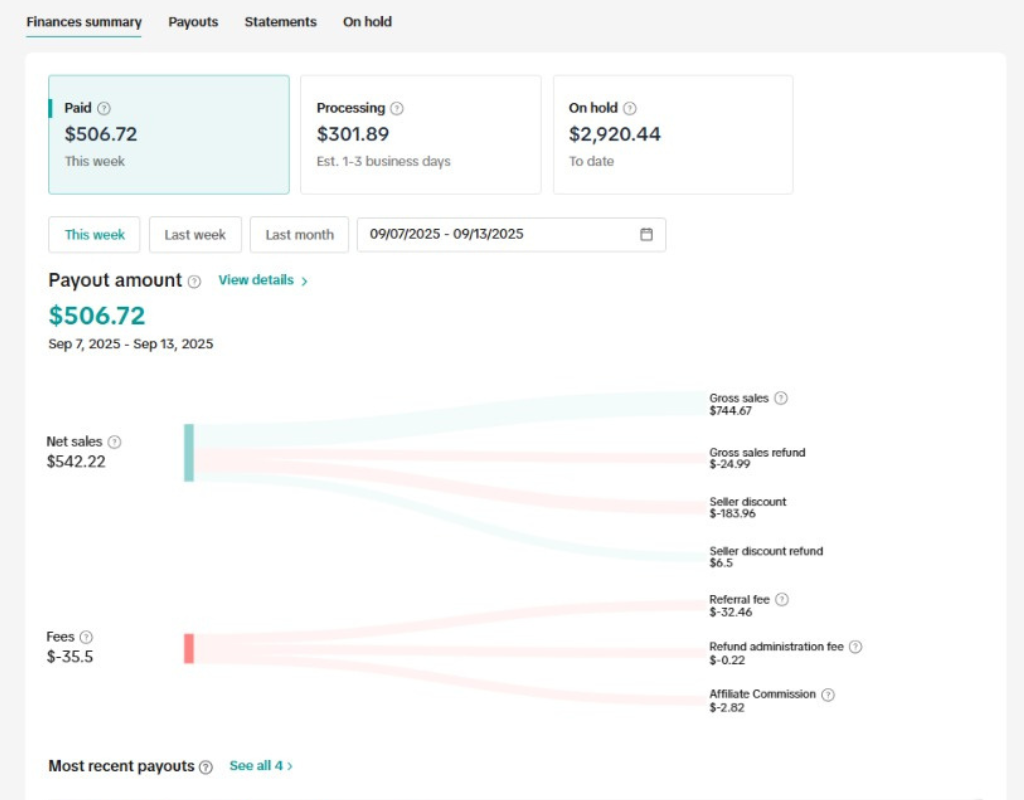

Here’s a detailed look at how the payout process works:

- Access the TikTok Shop Seller Center: Start by logging into your verified Seller Center account. This secure portal is where all financial settings and payout configurations are managed, built to handle the complexity of business transactions.

- Navigate to Financial Settings: Once inside, go to the “Finance” or “Payment Settings” tab. This is your central hub for managing bank account details and payout preferences.

- Link a Verified Bank Account: You’ll need to provide your bank’s name, account number, routing number, and the account holder’s name. Make sure the account name exactly matches the business registration details you provided during onboarding—this is crucial for verification.

- Complete the Micro-Deposit Verification: TikTok Shop will send a small test deposit, usually less than a dollar, to your account. Check your bank statement for the exact amount and confirm it in the Seller Center. This process, which can take one to three business days, confirms ownership and validates the account.

Once verified, your dashboard will show your account status as “Verified.” From there, TikTok processes customer payments and transfers funds to your bank account after a typical settlement period of one to two business days following a completed order.

Pro Tip: Use a dedicated business bank account for TikTok Shop transactions. This simplifies accounting, makes tax filing easier, and keeps personal finances separate, protecting your personal assets from potential business liabilities.

The Hidden Challenge of Manual Payout Management

Handling payouts manually may seem simple, but it quickly becomes a major headache as your business grows. Tracking payments, reconciling transactions, and ensuring accuracy can take up valuable time and create stress.

Scaling Becomes a Nightmare

With more orders, daily reconciliation can feel endless. Matching orders with payments and checking for discrepancies consumes hours that could be spent growing your business. High volumes make this process overwhelming and slow down cash flow management.

The Risk of Human Error

Manual data entry is prone to mistakes. Errors in profits, fees, or taxes can lead to inaccurate reports, compliance issues, and costly corrections. Even small mistakes can impact your bottom line and erode trust.

Lack of Real-Time Insight

Without automation, you’re always reviewing yesterday’s data. This delay makes it hard to react quickly to trends or spot problems early. Real-time visibility is essential for smooth operations, better cash flow, and faster decision-making.

Why Venmo Isn’t a Payout Option

After understanding the manual process of bank verification and payout management, a common question we hear is: “Why can I use Venmo for TikTok Ads but not for my TikTok Shop payouts?”

This is an excellent question, and the answer highlights a crucial distinction:

- TikTok Ads Payments are simple, direct transactions where you, the advertiser, are paying TikTok. For this, Venmo is accepted as a convenience.

- TikTok Shop Payouts are a complex settlement process where TikTok is paying you. This involves regulations, security, traceability, and high-volume transactions that require the stability of a traditional bank account.

But here’s the key takeaway: Even if Venmo were an option for payouts, it would only change the destination of the funds, not the management of them. Your real challenge isn’t the bank account itself; it’s the hours spent on reconciliation, the risk of human error, and the lack of real-time insight into your financial health.

A different payment method doesn’t automate your bookkeeping or generate your profit & loss statements. For that, you need a smarter approach—one that transforms financial chaos into effortless control.

The Automation Advantage: From Manual Chaos to Effortless Control

Manually verifying your bank account is just the first hurdle. The true bottleneck to scaling is the endless financial admin. Tracking countless orders, reconciling payouts, and investigating discrepancies can consume your entire day, pulling you away from growth-focused work like marketing and product development.

TikTok Shop automation services eliminate this burden by offering direct integration with the Seller Center, transforming financial operations.

- Eliminate Reconciliation Drudgery: Automatically match every order to its corresponding payout, instantly flagging any mismatches or missing payments so you never lose track of revenue.

- Gain Instant Financial Clarity: Access real-time dashboards that show your true net profit after fees, not just gross sales. Make data-driven decisions without ever opening a spreadsheet.

- Centralize Your Entire Empire: Manage multiple storefronts from a single dashboard. See consolidated financial data across all your TikTok Shop accounts for a unified view of your business health.

- Prevent Problems Before They Grow: Receive proactive alerts for failed payouts, verification requests, or spikes in refunds, allowing you to address issues before they impact your cash flow.

TikTok Shop Scams: What Buyers and Sellers Should Know

TikTok Shop has become a trusted platform for millions of shoppers and sellers—but its popularity has also made it a target for scammers. A wave of organized fraud, sometimes called “FraudOnTok,” tries to trick users into completing transactions outside the official checkout. The goal is simple: bypass TikTok Shop’s secure system and the protections it offers.

Common Scam Tactics

- Off-Platform Payment Requests: Scammers may pose as buyers or store reps, contacting you directly via messages. They often claim technical issues or offer a large order, asking for payment through Venmo, Zelle, or cryptocurrency. These apps are designed for friends and trusted contacts, not business transactions, so buyer and seller protections are limited. Paying this way can leave you with little recourse if the product never arrives or the payment is reversed.

- Fake “Business Account” Emails: Some scammers impersonate Venmo, claiming sellers must upgrade to a “business account” to receive payment. Their goal is to trick you into sending a “verification” payment or sharing sensitive information.

- Phishing for Verification Codes: Scammers might try to log into your account, triggering a multi-factor authentication code. They then call, pretending to be support, and ask for the code. Keep in mind: Venmo agents will never ask for this information.

- Requests for Remote Access: A “support agent” may ask to access your device to “fix” an issue. This is a major red flag—official support from TikTok, Venmo, or PayPal will never request remote access.

How to Stay Safe

The simplest way to protect yourself is to always complete transactions through the official TikTok Shop checkout. Sellers should never accept off-platform payments.

A clear, professional response works best: let buyers know all payments must go through TikTok Shop for security and tax purposes. Following these practices keeps your money safe and helps prevent scammers from taking advantage of you.

Troubleshooting Common Issues and Expert Tips

Whether you’re buying or selling on TikTok Shop, technical issues can occasionally arise. From payment failures for buyers to payout delays for sellers, understanding common problems and how to fix them can save time and prevent frustration. Community forums and support resources highlight several recurring issues along with practical solutions that go beyond the basic on-screen instructions.

For Buyers: Troubleshooting Payment Failures

Payment problems often arise from incorrect information, poor network connections, or bank authorization issues. If your payment fails, start by checking the basics: ensure your account has sufficient funds or credit, and verify that all payment details, card number, expiration date, and CVV, are entered correctly.

If the problem continues, try these steps:

- Clear Cache and Cookies: This can fix conflicts preventing the payment page from loading correctly. Using an incognito or private window can also bypass cached data.

- Disable VPNs and Pop-up Blockers: These tools may interfere with security verification steps like 3D Secure.

- Try a Different Browser or Device: A payment might fail on one device but succeed on another. Community discussions suggest that one payment method, such as a credit card, may fail while Venmo or PayPal works, showing that even supported options can be affected by technical or regional issues.

Refunds and TikTok Shop Balance

TikTok Shop uses a secure “TikTok Shop Balance” for refunds. When a purchase is refunded, the amount is credited to this balance, which can be used for future orders. This keeps funds within TikTok’s ecosystem, avoids issues with bank transfers or card refunds, and adds an extra layer of security and convenience for buyers.

For Sellers: Troubleshooting Payouts

Sellers may face issues with bank account verification or payout processing. Common causes include:

- Incorrect Banking Information: Ensure the bank account details match the business registration used during onboarding.

- Micro-Deposit Verification Delays: TikTok Shop sends a small test deposit to confirm ownership, which can take one to three business days. Delays may occur due to bank processing times.

- Platform or Regional Glitches: Occasionally, payouts may be delayed due to platform-specific issues. Logging out, clearing cache, or trying a different device can help isolate the problem.

While manual fixes may handle occasional hiccups, frequent payment or payout issues signal an inefficient workflow. For serious sellers, constantly troubleshooting drains time and energy that could be better spent on growth activities like marketing or product development.

Partnering with an agency like Tiksly that offers TikTok Shop automation services allows proactive monitoring of your store’s financial health. Many issues are identified and resolved before they impact your cash flow, keeping operations smooth and stress-free.

Expert Tip for Sellers: Always use a dedicated business bank account for TikTok Shop payouts. This simplifies accounting, protects personal assets, and ensures smoother transactions.

Conclusion

Venmo’s integration offers buyers a seamless checkout experience, while sellers receive payouts exclusively through verified bank accounts. This distinction is fundamental to TikTok Shop’s secure, regulated ecosystem.

The cardinal rule for all users is to conduct every transaction strictly within the official TikTok Shop platform. This is non-negotiable for ensuring built-in security, fraud protection, and payment guarantees. Any attempt to move a transaction off-platform is a definitive red flag.

While this structure is secure, managing its complexity, especially the manual reconciliation of payouts and orders, can be a significant burden for growing sellers.

This is where Tiksly transforms your operations. We automate the entire backend, from financial reconciliation and inventory syncing to order processing, freeing you to focus on strategy and revenue growth.

Stop letting manual tasks hold back your growth. Schedule your free 1:1 TikTok Shop consultation with our experts and see how customized automation solutions can save you time while protecting your profits.